Best AI Tools For Accounting

Artificial Intelligence (AI) is changing the way many industries work, and accounting is one of them. Using AI in accounting is not just a passing trend but a big change towards better efficiency and accuracy. Best AI tools for accounting help by automating routine tasks and giving deep insights through data analysis, making them essential in modern accounting.

The use of AI in accounting offers many benefits, like fewer manual errors, faster processing times, and the ability to handle large amounts of data easily. This article explores how AI is used in accounting, what to look for in AI tools, and how these advancements are setting new standards in financial management.

There are various AI tools on the internet that can add value to your workflow, such as AI writing, and many others so they also offer affiliate programs for users who want to generate money online, some of them offer weekly withdrawals.

How AI is Changing Accounting

AI helps automate repetitive tasks such as data entry, invoice processing, and payroll management, which allows accountants to focus on more strategic tasks like financial planning and analysis. AI can quickly analyze large amounts of data, finding patterns and anomalies that would take humans a long time to detect. This improves the accuracy of financial records and helps in early detection of fraud and errors.

AI-powered tools also provide real-time insights and forecasts, helping businesses make informed decisions. They can analyze past data to predict future trends, assisting companies in budgeting effectively and identifying potential financial risks before they become major issues.

Look For The Best AI Tools For Accounting

Choosing the right AI tool for accounting involves more than just looking for basic automation features. It’s important to consider the specific needs of your business and how an AI tool can meet those requirements. One key feature to look for is the ability to easily integrate with your existing accounting software and systems.

Security and compliance are also very important when dealing with financial data. AI tools should have strong security measures to protect sensitive information and ensure compliance with relevant regulations and standards. Look for tools that offer encryption, access controls, and regular security updates to keep your data safe.

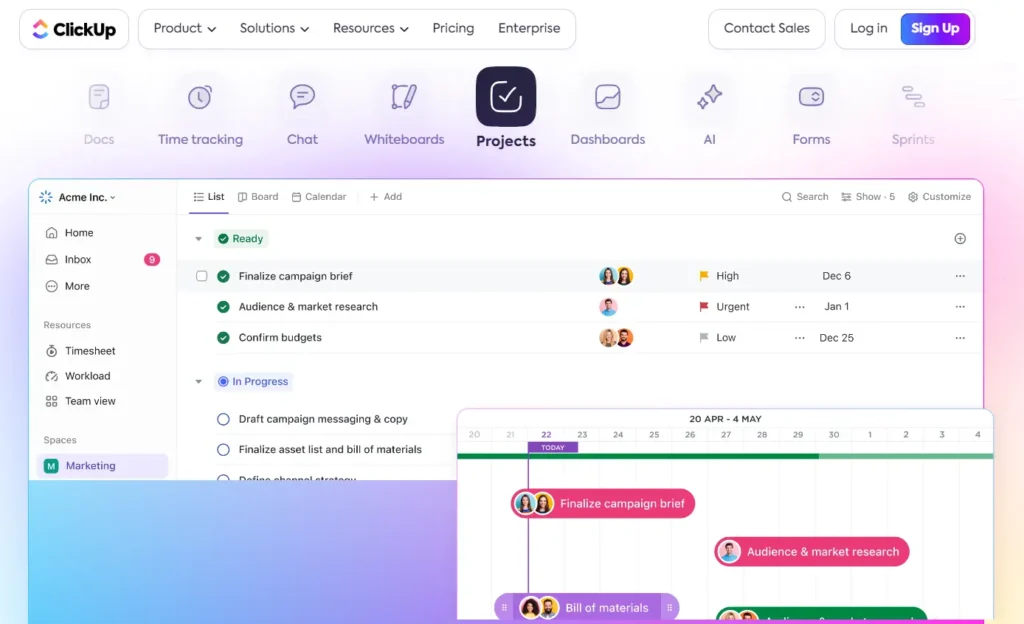

ClickUp

Whether you’re a small business owner or part of a big company, ClickUp Accounting is a powerful cloud-based platform that uses artificial intelligence (AI) to improve financial management. With ClickUp, you will improve and simplify various accounting tasks, making your workflow more efficient and productive.

One of the key strengths of ClickUp is its AI-powered ClickUp Brain. This feature can summarize financial planning meetings, connect with clients, outline audit policies, and update sales forecasting reports.

ClickUp’s flexibility is another major advantage. It can be customized to fit the unique needs of your business, whether you need to track expenses, manage invoices, or analyze financial data. The platform’s intuitive interface and powerful integrations make it a favorite among accountants looking for a comprehensive solution to their financial management needs.

Features of ClickUp

Limitations of ClickUp

While ClickUp offers numerous benefits, it’s important to be aware of its limitations. The platform can be complex for new users, requiring a learning curve to utilize its features fully. Additionally, while its customization options are extensive, they may require time and expertise to set up correctly. Lastly, although ClickUp provides robust support, it might only cover some specific accounting requirements, necessitating additional tools or plugins for comprehensive coverage.

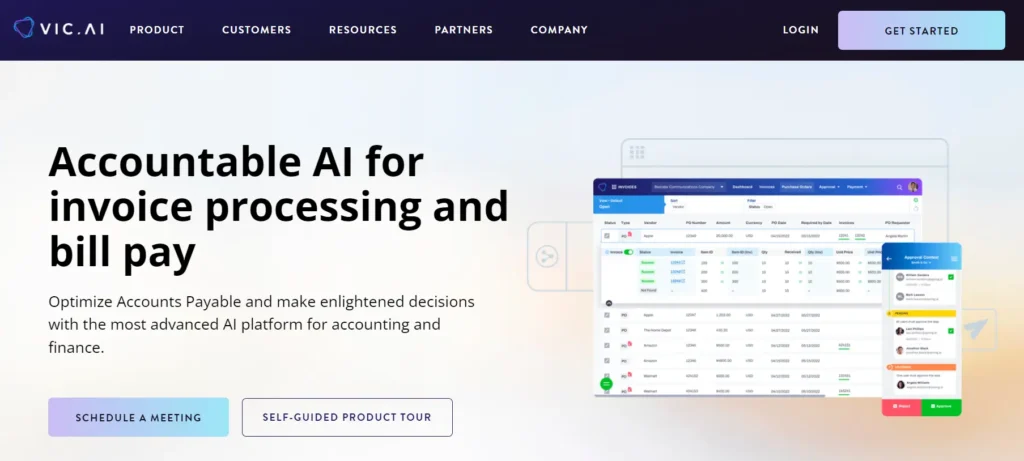

Vic.AI

Vic.ai is innovating the accounting industry with its advanced AI technology, designed to make accounting tasks easier and more accurate. This innovative tool uses artificial intelligence to process invoices, manage expenses, and ensure compliance, saving you time and reducing the risk of human error.

One of the standout features of Vic.ai is its ability to learn from your actions. As you use the platform, it gets smarter, learning to categorize expenses and recognize patterns, which enhances its accuracy over time. This means less manual data entry and more time for you to analyze financial data and make informed decisions. The more you use Vic.ai, the better it gets at predicting and managing your accounting tasks.

Vic.ai also excels in integrating with your existing accounting software, creating a seamless workflow. It can connect with tools like QuickBooks, Xero, and others, ensuring that all your financial data is synchronized and up-to-date. This integration eliminates the need for repetitive data entry and helps maintain consistency across all your financial records.

Another significant benefit of Vic.ai is its real-time processing capabilities. You no longer have to wait for end-of-month reports to understand your financial position, you get instant insights and can respond quickly to any financial issues.

Features of Vic.AI

Limitations

While Vic.ai offers significant advantages, there are some limitations to consider. The initial setup and learning phase might take some time, especially for those unfamiliar with AI tools. Additionally, some features might require higher-tier subscriptions, which could be a concern for small businesses on a tight budget.

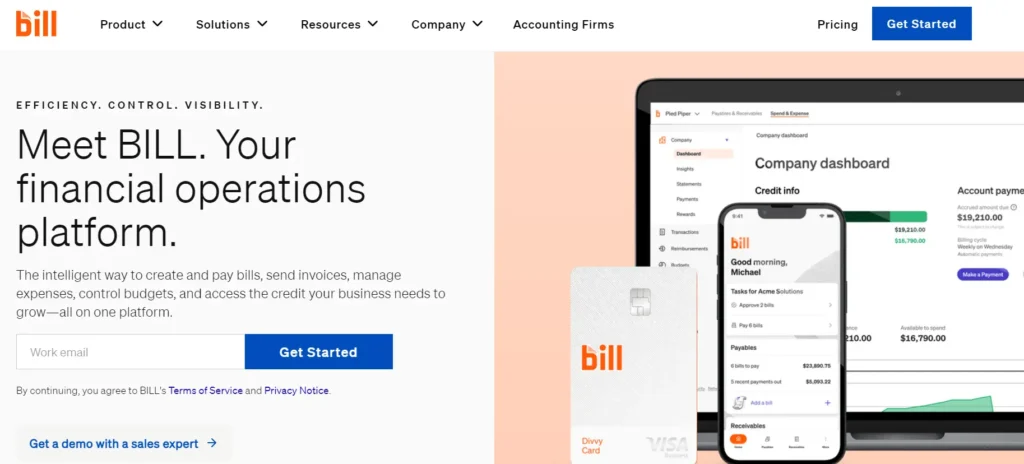

Bill

Handling payments and invoicing can be stressful, but Bill is here to make it easier. This platform is designed to simplify your financial processes, making your workday smoother and more efficient.

With Bill, managing your accounts payable and receivable is straightforward. The platform’s intuitive interface lets you quickly create and send invoices, track payments, and set up automatic reminders for overdue accounts. This means less worry about chasing late payments and more time to focus on your business.

Features of Bill

Limitations

While Bill offers many advantages, it does come with some limitations. Some services and individual transactions may incur fees, which could add to your costs. Additionally, Bill does not support all credit cards, payment methods, and currencies, which might limit its usefulness for some businesses. Despite these limitations, the convenience and efficiency Bill provides make it a valuable tool for managing payments and invoicing effectively.

Indy

For freelancers and independent contractors, managing finances can be a challenging task. Indy is an AI-powered platform designed to simplify and streamline accounting processes, making it easier for freelancers to handle their financial tasks efficiently.

Indy provides a user-friendly interface that allows you to easily create and send professional invoices. The platform also offers expense tracking, so you can keep an accurate record of all your business expenses. This not only helps in managing your cash flow but also ensures that you’re prepared to come tax time.

One of the standout features of Indy is its project management capabilities. You can organize your tasks, set deadlines, and monitor your progress, all within the same platform. This holistic approach helps you stay on top of your projects and ensures that nothing falls through the cracks. The integration of project management with financial tools makes Indy a comprehensive solution for freelancers.

Features of Indy

Limitations

While Indy offers many benefits, there are some limitations to consider. The platform may charge fees for certain advanced features or premium services, which could be a concern for freelancers on a tight budget.

Additionally, Indy might not support all payment methods and currencies, limiting its usability for some international clients. Despite these limitations, Indy’s ability to streamline both financial and project management tasks makes it a valuable tool for freelancers.

Zeni

Zeni is an AI-powered accounting tool tailored specifically for SaaS companies and modern startups. This innovative platform simplifies bookkeeping tasks and automates financial processes, allowing businesses to focus on growth and strategic planning. With Zeni, managing your finances becomes more efficient and accurate, making it an invaluable asset for emerging businesses.

Zeni excels in AI-powered bookkeeping, automating routine tasks such as transaction categorization and reconciliation. This ensures that your books are always current and error-free, saving you significant time and effort. Additionally, Zeni provides real-time insights into your financial data, enabling you to make informed decisions quickly and confidently.

Personalized support from accounting experts is another standout feature of Zeni. The platform offers access to professional guidance, ensuring that you have expert help whenever you need it. This personalized support is complemented by robust cash flow forecasting, which helps you anticipate future financial needs and plan accordingly.

Tax preparation is simplified with Zeni’s AI capabilities, streamlining the process and reducing the risk of errors. This feature ensures that your tax filings are accurate and timely, providing peace of mind and freeing you from the stress of tax season.

Features of Zeni

Limitations

While Zeni offers numerous benefits, it does have a few drawbacks. Some users have found that they need more detailed guidance on how to review and process financial data for better decision-making effectively.

The pricing structure of Zeni may be on the higher side for freelancers, entrepreneurs, and small startups, potentially making it less affordable for those with tight budgets. Despite these challenges, Zeni’s ability to improve financial accuracy and efficiency makes it a valuable tool for SaaS companies and modern startups.

Docyt

Docyt is an AI-powered bookkeeping platform designed to simplify and automate your back-office and accounting tasks. This innovative tool provides real-time financial insights, ensuring you have complete control over every aspect of your business’s finances. With Docyt, you can manage your accounting processes more efficiently.

Docyt is the ability to store all critical financial information and documents securely in one place. The platform allows you to create separate vaults for different projects or businesses, making it easy to organize and access your data. This feature ensures that your financial records are always accessible and well-protected.

Docyt excels in handling complex multi-entity accounting, simplifying what can often be a challenging task. It consolidates financial information from various entities into one easy-to-manage system, giving you a clear overview of your overall finances.

Features of Docyt

Limitations

While Docyt offers numerous benefits, there are some limitations to consider. Some users have noted that the platform can be relatively expensive, which might be a concern for smaller businesses or startups operating on tight budgets. The reliance on offshore customer support can lead to communication delays and challenges in getting timely responses.